Research from mid-summer 2020 showed a distinct partisan divide in how Americans viewed the pandemic. Republicans largely believed COVID-19 was an “Economic Crisis” and Democrats were much more likely to believe COVID-19 was a “Health Crisis.” As the crisis has worsened across most of the United States this fall – in terms of cases as well as economic hardship – there’s been a definitive shift in partisan attitudes.

What the data say

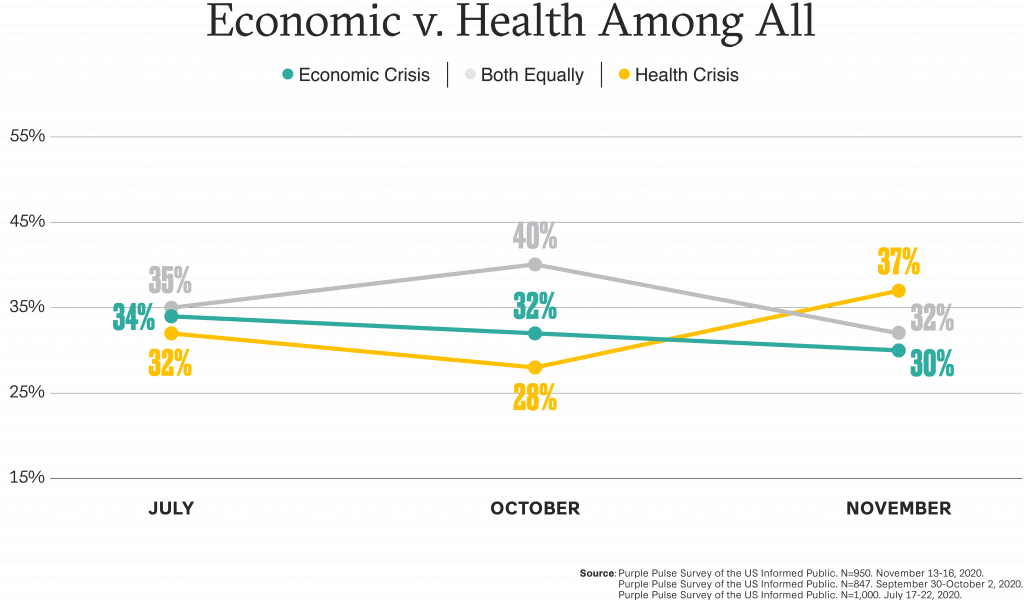

Concern about COVID-19 has shifted, from an “Economic Crisis” to primarily a “Health Crisis.” More Americans now believe COVID-19 is a Health crisis than an Economic one. Attitudes have tracked the path of the virus: in late summer and early fall, concerns about the health impact eased somewhat, while economic worries stayed consistent. But as case counts have surged, so too have concerns about the health impact of the virus.

- As the second wave of COVID-19 is sweeping the nation, today nearly two-in-five (37%) believe the crisis is primarily a health crisis, versus 30% who currently believe it is an economic one. This is a marked increase from late September when only 28% viewed COVID-19 as primarily a health crisis.

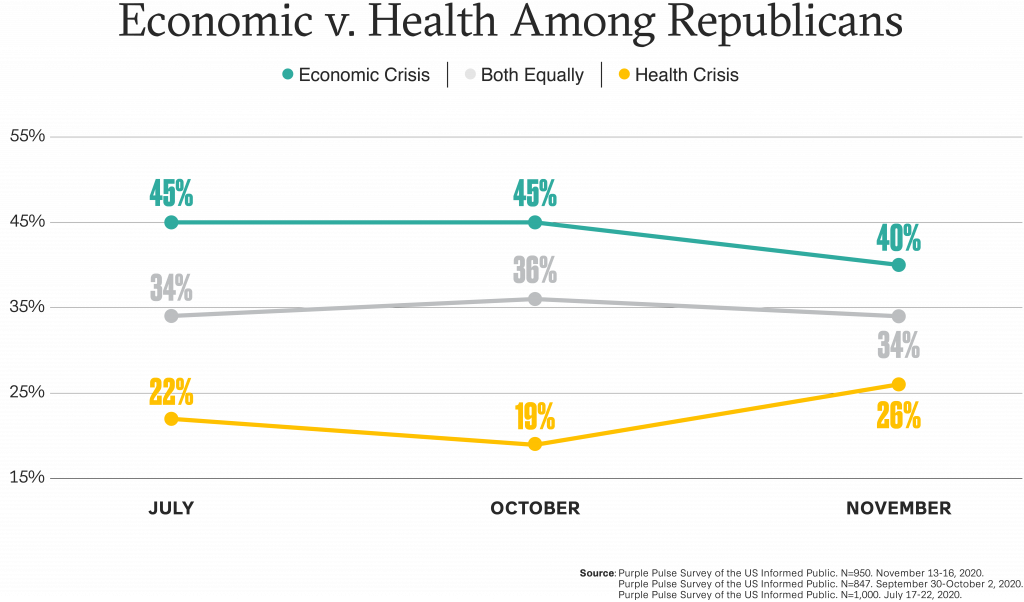

Partisan differences remain, but significant attitudinal changes reflect the second wave of the virus. As the virus surged outside of the coasts and throughout the Midwest, and thus out of left-leaning cities and into more suburban and rural areas dominated by Republicans, the health implications of COVID-19 have become front and center for more Americans.

- Republicans’ core concern about the economy is weakening. While a core group of Republicans still believe COVID-19 is an economic crisis (40%, compared to 45% in the summer/early fall), attitudes have shifted. A greater number of Republicans now believe that COVID-19 is a health crisis (26%), up 7 points from 19% in late summer and before the recent surge in cases.

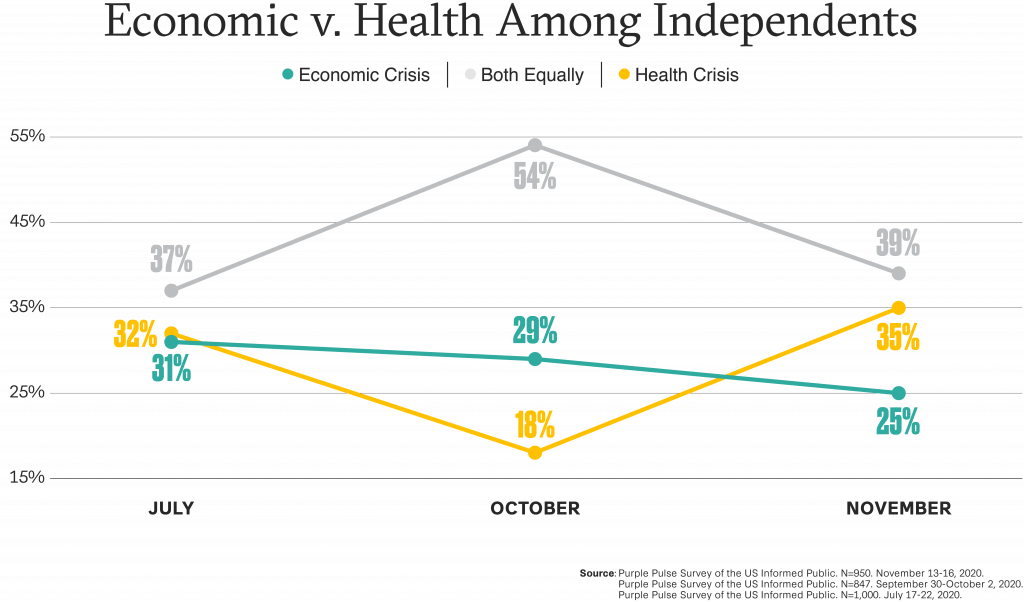

- Independents’ attitudes follow the virus. Independents’ attitudes have followed COVID-19’s progress through the country. Early in the summer, as the virus appeared to be coming under control, Independents were evenly split between believing the crisis was health (31%) or economic (32%). In early September, as many communities had observed several weeks of COVID-19 being more under control, the majority of Independents believed COVID-19 was a mix of an economic and health crisis (54%), and fewer than one-in-five (18%) believed it was mostly a health crisis. As cases surged in October and November, Independents have shifted dramatically to viewing the pandemic as a health crisis (from 18% to 35%).

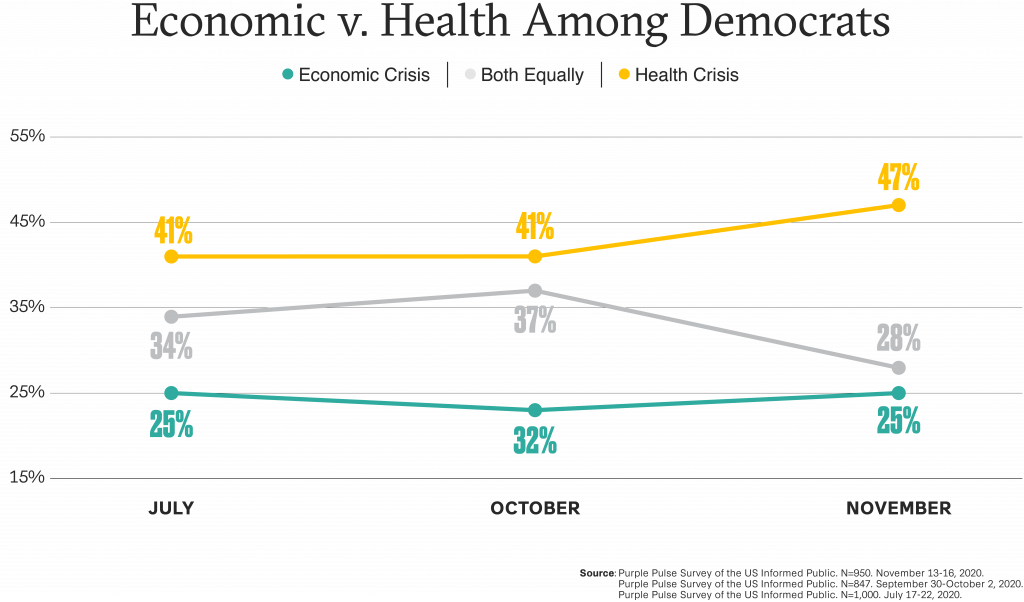

- Democrats remain focused on health considerations. Democrats have consistently been more likely to see COVID-19 as a health crisis, with more than two-in-five taking this view throughout the surges and retreats of the virus since summer. However, by our mid-November poll, that percentage shot up to 47%, while the number equivocating that the crisis is equally an economic and health crisis fell considerably.

What it means

The all-party increase in belief that COVID-19 is primarily a health crisis matches the surge in cases, but it does not indicate concern about the economic impact has dissipated. Political divides remain and impact how many are viewing the crisis. What does that mean for businesses?

- Health concerns will materialize in places where they may not have been a universal priority before the most recent surge in case counts – see the reversal of many GOP governors on mask mandates and mandatory business/school and new community lock downs and restrictions.

- Americans will continue to view opening and closing through their partisan values – though at this point the majority of Americans take the view that at least some restrictions will be necessary to get the virus under control.

- Republicans are less in favor of state and local governments mandating that businesses close entirely to reduce the spread of the virus, but most (60%) agree that some new restrictions will be necessary.

- Democrats will be skeptical of corporate intentions regarding balancing health and safety with decisions to stay/remain open; 60% think that states should do “whatever it takes” to reduce the spread of the virus, including forcing businesses to close temporarily.

Decision makers need to remain aware that customers and stakeholders are judging their COVID response plans through this ideology. How companies respond now has the potential to impact their reputation for the long term, which means hitting the cues and proactively planning for and managing reputational impact will be essential.

What we should do, a reminder

- Identify your bubble and step out of it. Attitudes for partisans are very consistent, but Independents are changing with the intensity of COVID in their communities. That means critics will come from both sides. Understand how your framing of announcements will be understood among those with different points of view to help to protect against the politicization of your actions.

- Heed the changing environment. Decisions need to be tempered and framed by what is happening in real time and adjusted as the circumstances shift. As caseloads grow, emphasizing health and safety will be critical, but as the pendulum swings back and access to a vaccine increases, economic concerns will be prioritized again.

- Talk about it. Communicating about your efforts must be more than a “checking the box,” one-time exercise. Communicate consistently the values that are driving your decision to re-open or stay closed. Be visible and vocal about how you are protecting employees and customers. Plan to communicate often, and as often as the situation is changing.

PURPLE PULSE SURVEY OF THE US INFORMED PUBLIC. N=950. NOVEMBER 13-16, 2020.

PURPLE PULSE SURVEY OF THE US INFORMED PUBLIC. N=847. SEPTEMBER 30-OCTOBER 2, 2020.

PURPLE PULSE SURVEY OF THE US INFORMED PUBLIC. N=1,000. JULY 17-22, 2020.

Purple is actively partnering with companies and industries to navigate the ever-changing COVID-19 pandemic and prepare for the future that will come after, bringing deep experience helping the world’s best-known companies navigate the world’s toughest challenges. Please reach out to author Sarah Simmons or any member of our Purple team to let us know how we can support you.

By Sarah Simmons | Managing Director | sarah.simmons@purplestrategies.com

Reclaiming Trust When Under Fire

Reclaiming Trust When Under Fire  Reclaiming Trust When Your Products – and Intentions &...

Reclaiming Trust When Your Products – and Intentions &...  Brad Dayspring Joins Purple Strategies as Executive Director

Brad Dayspring Joins Purple Strategies as Executive Director  Celebrating Growth and Leadership at Purple

Celebrating Growth and Leadership at Purple