The earnings call: the most underleveraged tool in reputation management.

By: Jason Bargnes and Erica Goldman

When was the last time someone besides an analyst or institutional investor looked forward to an earnings call? Companies spend as much as 50% of their communications planning time focused on these quarterly events, but they often use them to communicate only one (albeit very important) slice of information about their overall value. Is this a missed opportunity?

What We See:

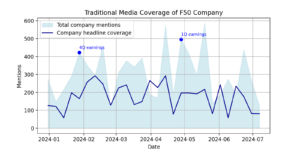

Most companies take a narrow view of earnings calls, focused only on updating shareholders and analysts about the company’s financial outlook. But these calls could be a powerful tool for building enterprise reputation equity. Purple’s research shows that quarterly earnings reports drive a significant portion of a company’s traditional media coverage, and multiple studies have shown that as much as 40% of a company’s market cap is based on reputation equity.

Given that earnings calls shape overall media coverage, they present a unique opportunity to reach multiple stakeholder audiences with a broader values story. However, many companies are not fully leveraging this potential.

- Earnings calls have barely evolved since the 1980s – they’ve just added presentation slides and video.

- Most companies deliver purely financial updates aimed solely at investors.

- Corporate financial teams often work in silos, disconnected from the teams that could help them tell a stronger story, like comms, brand, and external affairs.

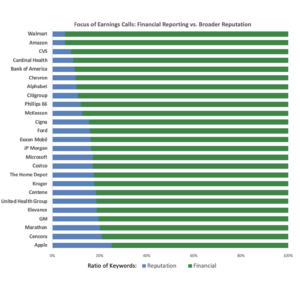

Our analysis of recent earnings calls from the top 25 Fortune 500 companies showed that most organizations primarily share financial updates and often forego reputation topics entirely (e.g., impact stories or employee highlights that can help establish the character of a company). Even among companies that do share broader stories—including Apple, Cencora, and Marathon—purely financial, investor-focused topics dominate.

What It Means:

Earnings calls are powerful platforms, and too many companies are missing a vital opportunity to tell a compelling enterprise value story that resonates with all license-to-operate stakeholders, not just financial audiences.

- Earnings calls receive national media coverage that likely reaches most of your critical stakeholders including regulators, policy makers and influencers, and future talent. But if you only share your financial news, that’s all reporters will cover.

- Investors are looking for insights on how companies are planning for the future beyond just the numbers, by managing emerging technologies and sustainability.

- Even financial audiences are bored by profits-only updates. PwC’s Global 2023 Investor Survey showed that 77% of investors want to hear more than just financials during earnings calls.

What You Should Do:

To transform your earnings calls from a common procedure into a powerful reputation-strengthening tool, start here.

Craft a Stakeholder-Centric Narrative:

Seize the opportunity to reach more stakeholders. Frame financial results within your company’s mission, vision, and values to tell a story that resonates beyond the profit margins. Recognize that financial outcomes may sometimes be at odds with the expectations or concerns of certain stakeholders.

Know Your Audience(s):

Remember, stakeholders are human too. Conduct and leverage audience research to understand what they want to hear from you and how to frame the issue to ensure your messages meet them where they are.

Integrate Financial Communications:

Break down silos! Integrate your financial communications team with comms, brand, government affairs and external affairs for a cohesive, impactful narrative across all channels that will speak to all of your license to operate stakeholders.

Engage and Amplify:

Treat your earnings call like a state of the union or political convention—energize your audience, build momentum, and reinforce your brand narrative for long-lasting impact.

We see two opportunities to optimize the investment made in earnings calls:

- Take greater advantage of the captive investor audience to deliver more compelling content and a message that goes beyond performance. Give them the opportunity to assign additional value to your character and connectedness to the future.

- Recognize that your earnings call is your biggest and best channel to reach additional audiences directly or just as importantly, to drive amplification of your message through other impactful channels, without further cost.

Are you ready to help your company optimize these opportunities? So are we. Just drop us a line and subscribe to our Purple Point newsletter here for more updates.

Your Earnings Call Just Testified Before Congress. Were You ...

Your Earnings Call Just Testified Before Congress. Were You ...  How can you hit the bullseye during the big game without bec...

How can you hit the bullseye during the big game without bec...  Patients Aren’t Patient Anymore

Patients Aren’t Patient Anymore  Washington’s New Normal: Why the Old Advocacy Playbook No Lo...

Washington’s New Normal: Why the Old Advocacy Playbook No Lo...