Rebecca Ballard

Posted on

February 24, 2021

10 Min. Read

Author

Purple Strategies

10 Challenges That Will Shape Year Two of COVID for Business Leaders

As we enter the second year of the COVID pandemic, Purple gathered a group of corporate reputation strategists who have spent the last year helping companies navigate some of the most important and central issues of COVID to identify key challenges that corporate leaders will likely face.

***

Purple is actively partnering with companies and industries to navigate the ever-changing COVID-19 pandemic and prepare for the future that will come after, bringing deep experience helping the world’s best-known companies navigate the world’s toughest challenges. Please reach out to any member of our Purple team to let us know how we can support you.

***

The intersection of the ongoing economic crisis, the continuing pandemic, the social justice movement and increasing inequality are just the short list of what leaders need to acknowledge, manage and help to solve.

Signing well-intentioned letters and making future commitments are sometimes appropriate but will not suffice at this moment. What is needed now are brave and courageous corporate leadership actions that can “bend the K-curve” economic recovery. Creation and adoption of employee policies and culture that accommodate varying degrees of fear, uncertainty, and unique personal circumstances will be essential. Leaders will need to imagine forward rather than look to playbooks of the past.

While companies will continue to deal with the pandemic head-on, we believe they will also increasingly have to navigate COVID in the background through two macro trends: (1) redefining “normal” as we return to normal, and (2) an acceleration of deepening societal divides in need of uniters. As seen through those lenses, here are 10 COVID challenges on the horizon for corporate boards and executive teams.

TREND 1: Return to “Normal”

The very notion of “normal” is now an unknown and shifting target. Corporate leaders must account for a multitude of ofttimes competing expectations from a complex web of stakeholders – employees, customers, communities, government, NGOs, climate activists, social champions – who all see business as critical to shaping a normalcy that works for many. Absent a shared understanding of “normal” or agreed-upon timetable for when that transition should occur, company leaders can expect to both drive and defend their decisions around the parameters of the new normal.

(1) As companies look to “build back better,” the question will be “better” for whom?

“Build back better” represents the Biden team’s economic recovery plan for American workers, pledging to “create millions of good-paying jobs” and to “treat American workers and working families as essential at all times, not just times of crisis.” But the hope for the American economy to be rebuilt in a more equitable way will be met with the reality that the radical changes in how companies worked during the pandemic will continue well past the pandemic’s end.

- Pandemic-necessitated automation is here to stay: The pandemic accelerated an already fast-moving trend away from high-touch jobs toward touchless alternatives – self-checkouts instead of cashiers, chatbots instead of call centers, automated toll tags instead of toll booth attendants, to name just a few. Companies that turned to technology to replace lost productivity during the pandemic are not likely to return to pre-COVID staffing levels, and additional job losses are likely as tech and automation solutions that went into development in the earliest shutdown come online in the days ahead.

- Desire for convenience will prevent return to pre-COVID consumer behaviors: American consumers have also benefited from convenience brought about by necessity – for example, the shift to e-commerce, which the pandemic accelerated by five years according to some estimates. Many consumers who initially adopted new habits during the pandemic to #flattenthecurve will give up their previous behaviors for good. But companies adapting to meet consumers’ shifting expectations and maintain efficiency gains will face reputational risk as a range of stakeholders question decisions that have directly or indirectly resulted in thousands of job losses.

- Transitioning workers will need a new champion: The pandemic has brought about the decline of jobs and industries faster than the impacted workforces can transition, and one of the primary safety nets in previous cycles – public funding of education – is itself a casualty of this pandemic. American businesses have an opportunity to fill this void.

(2) A permanent shift to work-from-home risks setting conditions for decreasing employee loyalty and increasing employee activism.

Many U.S. office workers who found themselves abruptly working from home in the interest of public health have now internalized work location flexibility as an expected benefit in corporate America’s “return to normal.” Companies wishing to retain and attract top talent will have no choice but to codify some level of workplace flexibility, and this shift away from central work locations will have several other potential repercussions.

- Work from home means anyone can work anywhere: Before the shift to remote work, some employees may have chosen to stay with their employer at least in part due to geography. While not the same as having a strong emotional connection to one’s employer, location nonetheless served as a reliable factor in talent retention. Greater work location flexibility will be an enduring effect of the pandemic. Employees will not easily part with what they clearly see as a benefit, and that same flexibility removes the geography-related obstacles to staying with one company.

- Decreasing connection to employers and co-workers: Workplace connections are another factor that fuel company satisfaction and loyalty, and COVID has disrupted the types of personal bonds between co-workers that form through social interactions outside of work. And employees hired during the COVID era have had few if any opportunities to form deep interpersonal relationships and connections with their co-workers at all.

- Company loyalty as a buffer against activism: As workplace personal relationships suffer, so too will company loyalty. Diminishing company loyalty (to the company or its people), in turn, lessens the hesitation some employees might normally feel going public with company issues, or conceals alternative (and more productive) internal avenues employees might have taken in the past to resolve issues and grievances.

(3) The CSR issue landscape will likely narrow but increase in importance in a depression-type era and climate emergency.

In a strong economy, thriving companies can look beyond the basics of their own financial health and security, and individual stakeholders have more leverage to demand companies deliver value beyond the bottom line. But the economic downturn prompted by COVID-19 has pushed many companies into survival mode – focused on business continuity and how to weather a storm of uncertain duration. As the pandemic economy continues, companies will not entirely abandon their CSR efforts, but some initiatives will be temporarily tabled, while others will become increasingly urgent.

- Divide over what to do, when: Partisan differences over which CSR initiatives to pursue and on what timeline won’t just play out in the political arena. They will also shape expectations and pressures on companies from external stakeholders and among their own employees. Conservative-leaning constituencies will push companies to focus on rebuilding the economy while liberal-leaning stakeholders will warn against delaying progress on priorities like social justice and climate change.

- Shared economic realities create attractive common ground: COVID’s economic impact has ignored party lines, making it an issue around which there’s a greater shared reality than many others in this pandemic. Providing economic relief will be a CSR territory on which corporate and political leaders from both sides of the aisle can cooperate.

- Convergence of business and social needs: Rather than forcing the selection of one or the other, companies and policy stakeholders will push for uniting economic and social needs. Action on a priority like infrastructure, for example, will also require making progress on the environment.

(4) The return to work and play will be both quicker and slower than Americans would like. Divergent expectations and lack of societal norms will create significant conflict that businesses will be forced to mediate.

From live events, to happy hours, to handshakes and hugs in social settings, being able to enjoy one another’s company in person again is one of the milestones most coveted by the public. Unfortunately, there will be no magic moment at which that milestone is achieved. Americans will have vastly different perspectives on when specific activities will be safe again, and under what circumstances, and businesses will be among the leading navigators of plotting the course back together.

- Vaccine policies and customer behavior intersect in the real world: Questions and concerns related to the COVID vaccine will move from the realm of public health officials and scientists to the realm of workers on the front line of businesses – the front desk worker in an office, the host or hostess in a restaurant, the greeter in a retail store, and the parking lot attendant at a concert venue, will need to become part of a company’s plans for enforcing the company’s vaccine policy with customers.

- Companies in a difficult position of mediating safety: Once government-directed safety protocols like mask mandates and capacity limitations start to ease, members of the public may still prefer that they continue for comfort and safety reasons. Companies will be in a position to set and enforce their own, custom network of regulations.

- Businesses will have to navigate the space between passionate camps: Compromise and diplomacy are often considered positive approaches to resolving differences, but they will prove to be ineffective in the face of the passions surrounding re-openings. Being in the middle of the “fast” and “slow” is a reputationally violent place to be and will present short- and long-term challenges for companies.

(5) Companies – and managers – will need to face America’s deteriorating mental health as it continues to directly impact the workplace.

News of COVID-19’s monumental impact on mental health is already well-documented. The effects of long-term isolation, reduced access to mental health services, the stress of managing the demands of work and home life, and the economic challenges people have faced, are just a few of many challenges COVID will leave in its wake. The pandemic’s mental health toll will continue having real implications for how businesses operate with employees and other stakeholders.

- Mental health as employer priority: In the near term, employers will be expected to continue investing time and resources into employees’ mental health in the form of mental health care coverage as well as policies like flexible hours, more direct engagement from managers, and health and wellness stipends.

- New spotlight on opioids: Companies already involved in defending against allegations of their role in the opioid crisis will face renewed attention and scrutiny for increases in addiction and dependencies resulting from the COVID era.

- Long-term impact on talent pipeline: While parents and schools are struggling with the learning and achievement gap now, employers will eventually be required to navigate the long-term effects of the “Quarantine Generation” or “Zoomers” – whose experience will have a lasting impact on their values, outlooks, and skillset.

TREND 2: The Acceleration of Deepening Divides, a Coming Reckoning, and the Need for Uniters

Deepening socio-economic divides have been exacerbated by a K-shaped recovery and the emergence of new segments of haves and have nots – who gets COVID, who gets the vaccine, who keeps their jobs. Companies will be forced to examine their own role in creating these divides while people will look to the private sector to bring about a sustained economic and societal recovery.

(6) The collapse of Main Street and small businesses will accelerate corporate reckoning over growing wealth inequality.

While the stock market has rebounded from early pandemic losses and many large corporations have reaped record profits, millions of American workers remain unemployed and more than 100,000 small businesses have permanently shuttered. With their commitment to the well-publicized Business Roundtable pledge serving as backdrop to the pandemic’s uneven devastation, companies will be held to account for their part in building an economy that does not serve all Americans.

- Reckoning and reform mindset: Calls for corporate accountability will grow and become a social and political norm. And with Democrats in full control of the federal government, corporations will see legislation that seeks to dramatically increase broad regulation, corporate accountability, and a rebalance of profits.

- Implications of a K-shaped recovery: As areas of the economy recover at different rates, the K-shaped recovery will have implications for how companies market to a divided customer base of haves and have nots. This will require a carefully calibrated strategy for targeting messaging at those fortunate enough to be on the upside of the K while so many remain in financial hardship.

- The end of “wealth worship” foreshadows broader shift in attitudes: American pop culture’s celebration of extreme wealth has seen a sharp pendulum swing as economic devastation has unequally impacted Americans. Celebrities and influencers who once racked up “likes” for ostentatious displays of wealth are now met with a flood of calls to “read the room.” This cultural shift will be felt across society and business.

(7) Social justice issues will stay front and center. Companies will face pressure to deliver beyond commitments made in 2020.

The disproportionate damage done to Black and Hispanic communities by COVID-19 will continue to surface systemic inequality in our society. In addition to broader social justice issues, three areas will emerge with COVID as the backdrop.

- Vaccine mandates reignite social justice tension and issues: Decades of mistreatment by the healthcare system has led Black Americans to pervasive mistrust of the healthcare industry, resulting in increased COVID vaccine hesitancy and significantly higher resistance to mandatory vaccination. A Purple survey in July 2020 found 51% of Black Americans would rather quit or be fired from their job than be required by their employer to take the vaccine. Vaccination policies for employees and customers may therefore have disproportionate exclusionary impact on people of color.

- Rubber hits the road on “making good”: The backlash over race-based vaccine prioritization plans foreshadows the coming challenges that society, government, and corporations will face as they begin to implement commitments made in the second half of 2020 to address racial equity and social justice.

- Long-term impact on communities: A significantly larger share of Black-owned small businesses have gone out of business, and schools where a majority of students are non-white are less likely to be equipped with the resources and infrastructure to support safe in-person or virtual school. Both of these issues will contribute to short- and long-term equity issues, requiring immediate intervention, and presenting a lane for companies to invest in near-term aid and long-term solutions.

(8) The disappearance of women from the workforce will worsen, undermining diversity, wiping out hard-fought gains in leadership and pay equity, and robbing the future talent pipeline of female leaders.

Forward-looking companies have worked hard to differentiate in the area of gender diversity, investing heavily in attracting, retaining and promoting women; recruiting women to serve on their executive teams and boards; and setting executive KPIs, sustainability goals and public commitments related to advancing women in their workforces. Pandemic burdens being shouldered by women, in particular, are putting all of those gains at risk. Companies will need to enact measures to retain talent and engender loyalty, balancing the sometimes-conflicting needs of parents and non-parents alike, to remain competitive now and protect women leaders for their leadership pipeline.

- Childcare duties continue to derail workdays: As long as schools and daycares remain closed (or inconsistently open), women will continue to take on the overwhelming majority of the resultant child care responsibilities alongside their professional workloads.

- Disappearing jobs are more likely women’s jobs: Women are experiencing a disproportionate number of COVID job losses since they are a large percentage of the workforce in industries hit hardest, such as hospitality, travel, and service.

- COVID economics exacerbate standard gender stumbling blocks: Pre-existing hurdles for women in the workplace, like the gender pay gap and less frequent promotions than male counterparts, mean COVID economic-protection measures like freezes on pay raises and promotions have an outsized impact on women.

- Added insecurity in family finances ripple into broader economy: Fewer female wage earners will translate to less stability in household incomes, and lessened ability for families to make payments on mortgages, credit card debt, student loans, and other needs – not to mention the impact on discretionary consumer spending.

(9) Work from home and work from office will create a two-tiered workforce both within and across companies and industries.

Early on, the pandemic highlighted the split between essential and non-essential workers. Another type of employment divide is about to come into focus as companies navigate their new work normal: the divide between those working from home and not. Some will be able to choose their work location while others will not be given a choice, and employers will have to navigate the different expectations and experiences of both groups.

- Ensuring equitable benefits: Companies will need to develop and apply practices and policies equitably across groups and anticipate and manage the inevitable disparities arising from a two-tiered workforce. For example, companies will need to protect non-working hours for those working from home to ensure they don’t feel like they’re unfairly burdened by blurred work/home lines, or extend comparable flexibility (or something of comparable value) to those working in the office.

- Divides between the can (work from home) and the cannots: Tension will continue to build between employees who want to work from home and aren’t able to and those who can, potentially putting company leaders on the defensive to justify decision-making.

- The in-person/remote team split will solidify: Corporate and team structures will need to shift to effectively accommodate hybrid teams, ensuring productivity across work formats.

(10) The treatment of and reliance on essential workers throughout the pandemic will lead to a re-emergence of labor during the early days of the Biden administration.

Americans have relied on “Essential Workers” throughout the pandemic to provide vital services – including health care, emergency services, food production, and transportation and delivery – that enabled the U.S. economy to keep running. But the treatment of front-line workers has been a particular challenge, as many have worked without basic protections such as PPE, paid sick leave, increases in pay, or job security – and that is on top of many of these jobs being low-wage, to begin with. As the pandemic stretches into a second year and a new administration takes over, better pay and protections for essential workers will be more of a priority than they have been to date.

- Pro-labor federal government: The Biden administration has already signaled that it will be a friendlier environment for labor, including easing restrictions on workers organizing and collective bargaining. With fewer obstacles, a friend in the White House, and majorities in the House and Senate, labor will organize to demand better pay and protections for essential workers in 2021.

- More allies for essential workers: Social justice activists, as well as large swaths of the American public, will support greater protections for the workers who continue to care for America as most of the country remains in quarantine mode for the next several months.

A version of this article first appeared in Fast Company

Purple is actively partnering with companies and industries to navigate the ever-changing COVID-19 pandemic and prepare for the future that will come after, bringing deep experience helping the world’s best-known companies navigate the world’s toughest challenges. This article was developed during a Futurecasting by Purple StrategiesTM workshop by Purple’s Alec Jacobs, Ashley Gibaldi, Bradley Engle, Chris Durlak, Denise Brien, Diana Muggeridge, Erica Goldman, Nate Byer, Nicki Zink, Rebecca Ballard, Robert Fronk, Rory Cooper, and Sarah Simmons. Please reach out to any member of our Purple team to let us know how we can support you.

Posted on

February 19, 2021

4 Min. Read

Author

Kayla Johnson

What Financial Trading Apps Can Learn From Responsible Gaming Companies

App-based financial investing platforms have had breakout success during the pandemic, with millions of new Americans taking an increased interest in investing. The disruption brought by these financial startups was built on the premise of democratizing access to investing: removing barriers so that all investors – not just large institutions and wealthy individuals – have the opportunity to grow their wealth.

But like any disruptive technology, these startups bring potential for a perilous future as well.

Critics of this new wave of investing apps believe the companies operate irresponsibly without common safeguards from the financial services industry and are exposing amateur investors to a level of risk they don’t understand and for which they aren’t prepared.

Further, critics point out that some new investing apps use the same “growth hacking” techniques many social media companies have used to keep their users spending time in their app, making this new generation of investing apps “addictive by design.” These include:

- Subtle design tweaks such as labeling cash “buying power” encourage the full investment of money in user accounts rather than encouraging an asset allocation investing strategy.

- Gamification tactics like “most popular stocks” and “biggest daily movers” cause users to feel they are missing out and create psychological pressure to try to find the next big winner through potentially risky investments.

- “Instant deposits” allow investors to transfer money from their bank account and invest it immediately creating a dopamine rush. But users are required to wait multiple days after selling an investment before they have the option to initiate a transfer of money back to their bank, increasing the likelihood that money will be reinvested with new trades.

For at least a subset of new investors, day trading and short-term investing filled an entertainment gap when the sports world suddenly ended last March. In a stock market “that only goes up,” the risk of gambling-like behavior has been masked by the perceived safety of investing, causing even more new investors to jump in. But when the bubble inevitably pops, many people could lose it all. And the media, government and society will be looking for someone to hold accountable.

While stating “all investments involve risks, including the possible loss of capital” may avoid legal liability, these investing start-ups risk losing their permission to operate and innovate and could cease to exist unless they take real action to protect their users. As we will likely see in the aftermath of the Wall Street Bets saga, disruption in a highly regulated industry like the financial industry has the potential to be met with a level of regulation that start-ups and the tech world are not accustomed to.

Those practices could start with the design of the very applications that are intended to be mobile-first, accessible and intuitive – yet bear a strong resemblance to gambling activities in casinos and online gaming.

Lessons from The Gaming Industry’s Successful Model of Self-Regulation

While casinos and gaming companies are notorious for manufacturing and designing machines, games and experiences that enable casino players to spend more money and gamble longer, they also have robust responsible gaming programs in place to reduce gambling-related harm and help guests make informed decisions to keep gambling fun.

Rather than intentionally exploiting addiction, gaming trade groups and leading gaming companies have partnered with outside experts and academia to develop science-based approaches to encourage responsible gaming. For them, it’s the right thing to do as responsible companies, and this type of successful self-regulation has prevented further government regulation that could restrict their license to operate.

Here are four lessons from the gaming industry that investment startups and the financial services industry can leverage to provide greater protection for their reputations and customers.

(1) Invest in Responsible Gaming Initiatives and Programs

While many casinos and gaming companies are required to have responsible gaming programs in place as a condition of licensing, some have decided it is a critical part of being a responsible company and have gone above and beyond to integrate responsible gaming into everyday business practices.

Gaming companies have found a way to share healthy gaming practices in messaging to customers so they can understand the games better, but also better understand the basic concepts of gambling. This includes:

- Encouraging customers to take frequent breaks while gambling. Set a time limit.

- Control your wagers, don’t let them control you.

- Don’t gamble money that you can’t afford to lose, and don’t borrow money to gamble. Set a budget.

(2) Empower Employees to Protect Your Customers

In addition to providing educational resources for players, many gaming companies have gone a step further and hired dedicated gaming advisors for players who prefer additional guidance through verbal interactions and one-on-one support. The advisors receive extensive training for preventing gaming addiction and have the ability to provide referrals to free professional counseling services.

(3) Regular Reminders in-App, in Social, in Marketing

Responsible gaming companies take every possible opportunity to reinforce responsible gaming messaging, which are ultimately designed to create healthier gaming habits for their customers. Best practices include:

- Advertising materials (print, digital, etc.) are required to include a responsible gaming message, including a toll-free hotline number and website that the customer can access for assistance or resources for counseling.

- The materials are also required not to contain any claims that gambling will guarantee a customer’s social, financial or personal success or create a suggestion that gambling will lead to the probability of gains.

- Disclaimers containing hotline phone numbers are also listed in all social media postings, whether in the cover photo of social platforms or within the copy of the social post or an overlay on published creative assets.

(4) Self-Restriction Program

Through self-restriction and self-exclusion programs, customers can exclude themselves from casinos and online gaming apps, revoking all gaming privileges. Gaming operators in certain states are also required by law to remove customers from receiving direct marketing outreach and promotional materials. For customers who do not fully opt-out of gaming, they have the option to establish self-imposed limits on the amount of money they gamble with as well as time spent doing so. These limits and credit restrictions are in place to deter customers from betting more than they can afford to lose.

By being proactive and looking to the gaming industry’s successful self-regulation as a model, financial trading apps have an opportunity to protect their license to operate and build up the reputation equity that helps them responsibly serve the markets and investors.

Kayla Johnson is a campaign innovation manager at Purple Strategies where she helps client teams to better solve corporate reputation challenges using Purple’s proprietary digital solutions. Kayla spent five years working in the gaming industry for MGM Resorts International leading social media strategies. Prior to joining Purple, Kayla served as a state digital director for the Biden for President campaign.

Posted on

February 10, 2021

1 Min. Read

Author

Purple Strategies

Orphan Drugs, Pricing, And Reputation Risk

A “Life Science Leader” guest column by Purple MD Crystal Benton

Pharmaceutical companies got a reputation boost from their role in COVID-19 response. As these companies look to their next drug development and launch, a shift in approach could mitigate their reputation risk, Purple Managing Director Crystal Benton writes in a guest column for Life Science Leader.

“Reputation drag from ill-planned, high-cost launches could drain much, if not all, of the equity the industry has built through its efforts to rescue the world from the pandemic. And Washington has a notoriously short memory. … Mitigating that risk requires an enhanced approach that goes beyond brand marketing, for which many companies are not prepared. Pharmaceutical company leadership should consider three shifts in their approach to the drug development and launch process.”

Read the full article at LifeScienceLeader.com.

Posted on

January 28, 2021

5 Min. Read

Author

Nate Byer

Three Challenges Corporations Should Prepare for Now in the Post-COVID Economy

With the COVID-19 pandemic in the U.S. raging, it’s hard to find a moment to think about what our world will look like when the dust settles on this devastating health crisis. COVID-19 has and continues to pose an unprecedented challenge and regardless of partisan identity, Americans are seeing that challenge first and foremost as a health crisis.

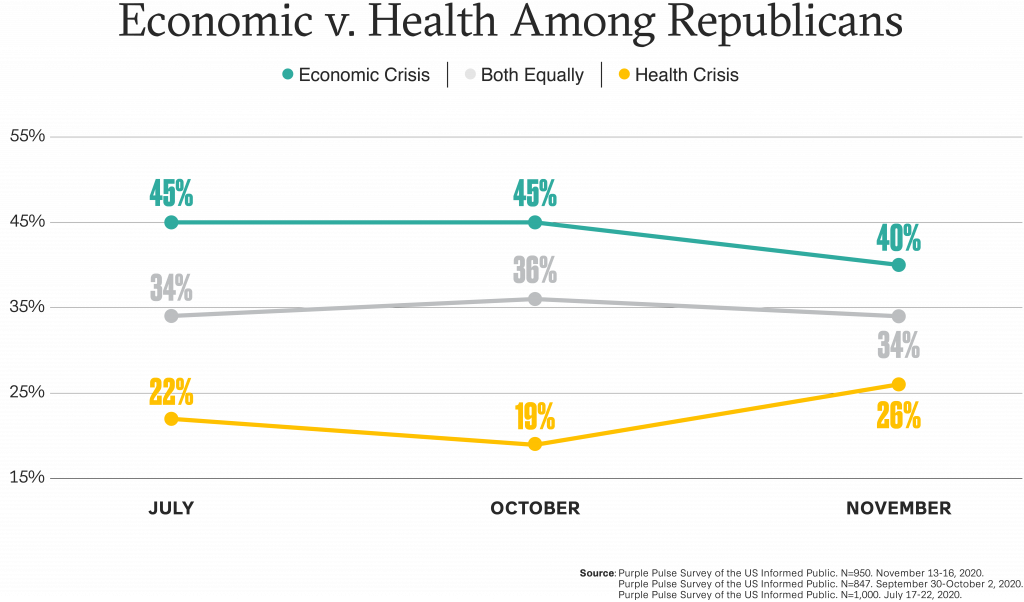

It hasn’t always been that way. Our research focused on tracking beliefs about COVID-19 in early- and mid-2020 uncovered connections between Americans’ partisan identity and perceptions of what type of crisis we were facing. Simply put—early in the year, Republicans were more likely to see COVID-19 as an economic crisis, while Democrats more likely to see it as a health crisis.

As the fall and winter wore on, we saw a shift: Americans started believing COVID-19 was a health crisis more than an economic one, with a corresponding drop in those saying it was equally a health and economic crisis.

So what’s next? We all hope that as the depressingly high daily death tolls subside, and vaccination totals increase, we’ll be able to get back to normal. But while we may be able to visit our loved ones or step into a restaurant without fear, the reality is that the long-term economic impact of this crisis will have the spotlight to itself.

Corporate leaders need to start thinking now about how they want their companies to show up in that new reality, because the responsibility that corporate America has to their employees, their communities, and the nation will be a defining question of 2021.

There are three core economic topics that communications leaders should start working on now to help future-proof their businesses:

TOPIC 1

The growing disconnect between Wall Street and Main Street

Challenge

With Wall Street analysts predicting calm financial waters and continued stock market growth in 2021, we can expect continued frustration with the clear and present disconnect between how Wall Street thrives and Main Street struggles. The labor market clearly has a long way to go on the economic road to recovery, and we can expect a significant reform agenda on financial issues under a Biden administration, especially if Gary Gensler, a progressive former financial regulator and banker, is confirmed to lead the Securities and Exchange Commission.

Considerations

- Be mindful that investor communications do not exist in a vacuum. What you communicate to the financial community, especially during times of economic tension, will form the foundation of your corporate narrative for all stakeholders.

- Focus on investments that will allow you to succeed in the future. Investors, employees, customers and consumers need stability, so it will be well-received to talk about how you’re using your short-term success to build a strong foundation they can rely on.

- Elevate compelling voices from within, diversifying who carries your message both within and beyond the C-Suite.

TOPIC 2

Heightened employee concern about the future and the need to engage early and often

Challenge

The U.S. economy shed 140,000 jobs in December — the first month of decline since the earliest months of the pandemic. Our recovery has reversed as the pandemic has worsened and Congress has consistently failed to act.

The Biden administration will face significant economic challenges with the end of the pandemic still out of sight and political crisis consuming Washington yet again. Uncertainty about job security and burnout are real, and discord from inside (whether organic or organized) can be a killer for morale and your business’s ability to thrive.

Considerations

- Clearly and consistently communicate your values and how they inform your business decisions. Start building the muscle now so when employees voice concern or mobilize to apply pressure, you have built a strong foundation.

- Understand your liabilities related to controversial topics and government connections (such as donations to “Stop the Steal”–supporting members of Congress). The Project Lincoln divestment campaign is just the beginning of external pressure that will demand greater transparency and alignment with values as to how companies operate in the political arena.

- Commit now to regularly engaging your people on critical topics of a sociopolitical relevance. 2021 will be a year in which companies are expected to have a point of view on topics that go beyond the business of their business. Enlist your employees in helping you form, articulate, and defend your positions.

TOPIC 3

The high expectations for companies to have a positive impact in their communities, especially in the absence of trusted government institutions

Challenge

As a country, we no longer have faith in government’s ability to solve big (or sometimes even small) problems. And trust in once-revered institutions continues to nosedive following the 2020 election. As Axios reported, “business is the only institution that is now perceived as being both ethical and competent enough to solve the world’s problems. CEOs are the only societal leaders trusted to tell the truth and fix problems.”

Americans are struggling by almost every metric and the urgency of our challenges on everything from poverty and hunger to the environment is only increasing. Relatively small investments in community-focused corporate social responsibility (CSR) will not only make an impact on the ground, but also build credibility for companies in the short-term and down the line. That’s especially true when the problems companies tackle, and talk about tackling, are aligned with national priorities connected to but not impacting a company’s bottom line.

Considerations

- Relevant social impact work isn’t optional. Even if the mission is long-term, companies need to be in the game, living their purpose beyond the core of their business. Employees, investors, and policy makers expect it. Pick your topics, understand your potential impact, and start making investments.

- Don’t go it alone – engage your network (suppliers, customers, investors) to build a more impactful and resilient social impact program. Increase your chances of being seen as an agent of change by bringing others along with you.

- Resist the urge to talk about yourself and the size of your contribution. Talking about investments puts you in a sea of CSR sameness. Instead focus on the impact, showing not telling, and deprioritize your own logo and name in communications as much as possible.

CONCLUSION

We may see light at the end of the COVID-19 tunnel, but we have a long road to recovery ahead. Rebuilding an economy that meets the persistent needs of “Main Street” will take center stage soon enough, and companies need to be ready. That means having communications in place that reconcile the Wall Street/Main Street divide, programs established that embrace and support employee priorities, and investments made in precedent-setting programs dedicated to making relevant and lasting positive social impact. Doing these three things now can ensure that a company is ready for the pendulum swing from health crisis to economic crisis in 2021.

Purple is actively partnering with companies and industries to navigate the ever-changing COVID-19 pandemic and prepare for the future that will come after, bringing deep experience helping the world’s best-known companies navigate the world’s toughest challenges. Please reach out to author Nate Byer or any member of our Purple team to let us know how we can support you.

By Nate Byer | Managing Director | nate.byer@purplestrategies.com

Posted on

January 22, 2021

3 Min. Read

Author

Robert Fronk

Science Led Us To Vaccines, But It Will Take A Political-Style Campaign To Get Us To Vaccinations

There are suddenly glimmers of hope in our fight to contain and ultimately extinguish the COVID-19 pandemic. With two vaccines already approved for emergency use, others nearing the end of clinical trials, shots going into arms, and the number of Americans who say they are going to get the vaccine rising over the past 90 days, there are reasons for tempered optimism.

But like the virus itself, challenges continue to mutate, creating the need (and opportunity) for corporate leaders to adapt and commit to actions, which they are uniquely qualified to take, that put the collective good first, but also ultimately benefit their companies.

In order to move from vaccine development to herd-immunity vaccination coverage, expertise and activation in the areas of logistics coupled with personalized communication to drive product acceptance are required. And there is no group better equipped and suited to deliver these than American businesses.

As our focus shifts rapidly from vaccines to vaccinations, what insights can we extract from our most recent research and what does this mean for corporate leaders?

Among a range of options about what makes the Informed Public* more optimistic post-election versus September, “companies and government working together on the pandemic response” is the top answer among both Democrats and Republicans. While Operation Warp Speed certainly accelerated the development of vaccines and vaccine candidates, distribution might better be executed – and trusted – if handled by organizations used to getting the right products at the right time to the right places to thousands of locations and made available where “customers” want them. Shipping product is not the same as product availability.

But availability is just the start. Vaccination is a personal choice, similar to the choice people have of whether or not to vote, and if they decide to vote, who to vote for. And when it comes to COVID-19, we need to get people to vote with their arms!

So how do we get out the vote and get people to punch the vaccination ballot?

Successful political campaigns employ two critical approaches to persuade voters to choose their candidate:

- Identify the messengers, channels and messages most appropriate to each potential voter

- Focus most of the attention on the undecided or persuadable segment of the electorate

How does this campaign approach apply to vaccination? The days of asking Elvis to get inoculated against polio live on the Ed Sullivan Show, driving public acceptance of a vaccine, are over. So too are one-size-fits-all public service campaigns. What is needed is a modern communication effort, based upon the principles of successful political-style campaigns. We need to truly understand who has credibility and sway over unique segments of the public, where and how to reach them, with personally relevant, compelling messages that move them to action.

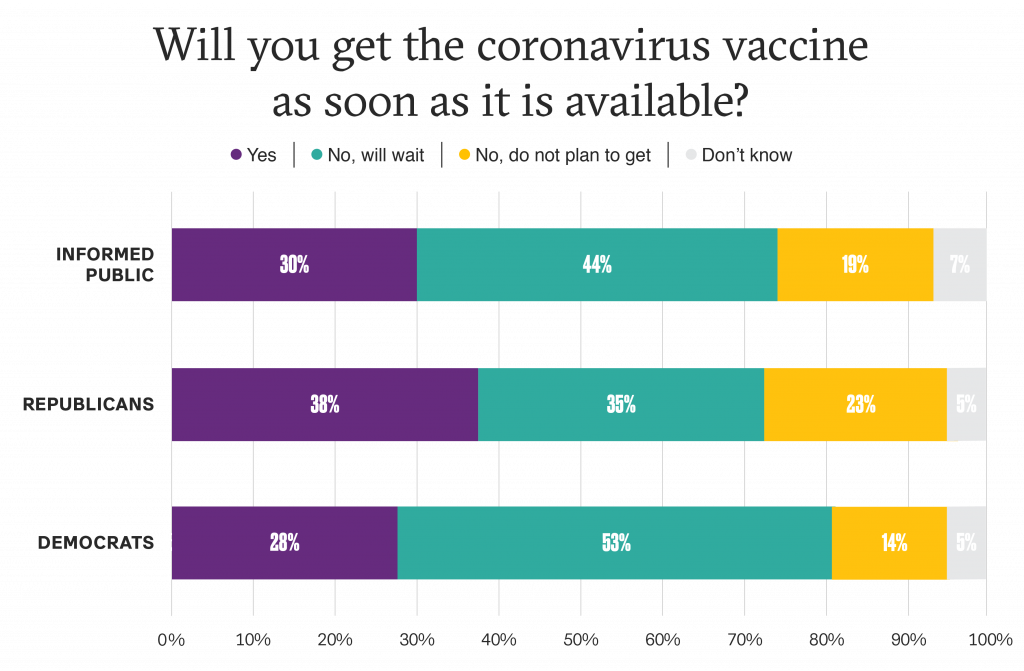

There has been much made of the vaccine-hesitant and the anti-vaxxers. But these labels won’t help us get to herd immunity. In our research, we have identified two critical, persuadable segments that will determine if we reach the vaccination levels that Dr. Fauci says are essential to creating herd immunity (75% to 80% of the population).

The first of these segments is the “Probably, But” segment, which comprises 35% of the Informed Public. This group, who ultimately expect to get vaccinated but plan to wait and see for many months, is twice the size of those who say they will not get the vaccine. We can get to 75% vaccination without the latter, but we need to motivate the former.

In political terms, the “Probably, Buts” are in essence waiting to see who wins the election before they are prepared to vote. A campaign specifically designed to upend this dynamic is essential – one uses the voices, messages and channels that are shown through research and testing to be best able to impact this segment.

Of equal importance is the segment representing 58% of the Informed Public, the “Cutting Corners Questioners,” who have questions about the safety and efficacy of vaccines brought to market so quickly. This segment wants to know that the “candidates” have the highest character, the election will be fair, and it is safe to vote. There are very specific voices and messages that are needed to alleviate the concerns of this sizeable and critical segment.

Just looking at these two segments, it is clear that no single national campaign to reach them will be effective.

At a national moment when companies are suspending political contributions, there is one candidate they can all support – vaccinations – and the campaign requires their resources and expertise to succeed.

PURPLE PULSE SURVEY OF THE US INFORMED PUBLIC. N=950. NOVEMBER 13-16, 2020.

PURPLE PULSE SURVEY OF THE US INFORMED PUBLIC. N=847. SEPTEMBER 30-OCTOBER 2, 2020.

PURPLE PULSE SURVEY OF THE US INFORMED PUBLIC. N=1,000. JULY 17-22, 2020.

* Surveys of the “informed public” – defined as adults who read the news at least a few times a week and closely follow at least one broad news topic

Purple is actively partnering with companies and industries to navigate the ever-changing COVID-19 pandemic and prepare for the future that will come after, bringing deep experience helping the world’s best-known companies navigate the world’s toughest challenges. Please reach out to author Robert Fronk or any member of our Purple team to let us know how we can support you.

By Robert Fronk | Managing Director | robert.fronk@purplestrategies.com

(A version of this article first appeared on LinkedIn)

Posted on

December 16, 2020

3 Min. Read

Author

Denise Brien

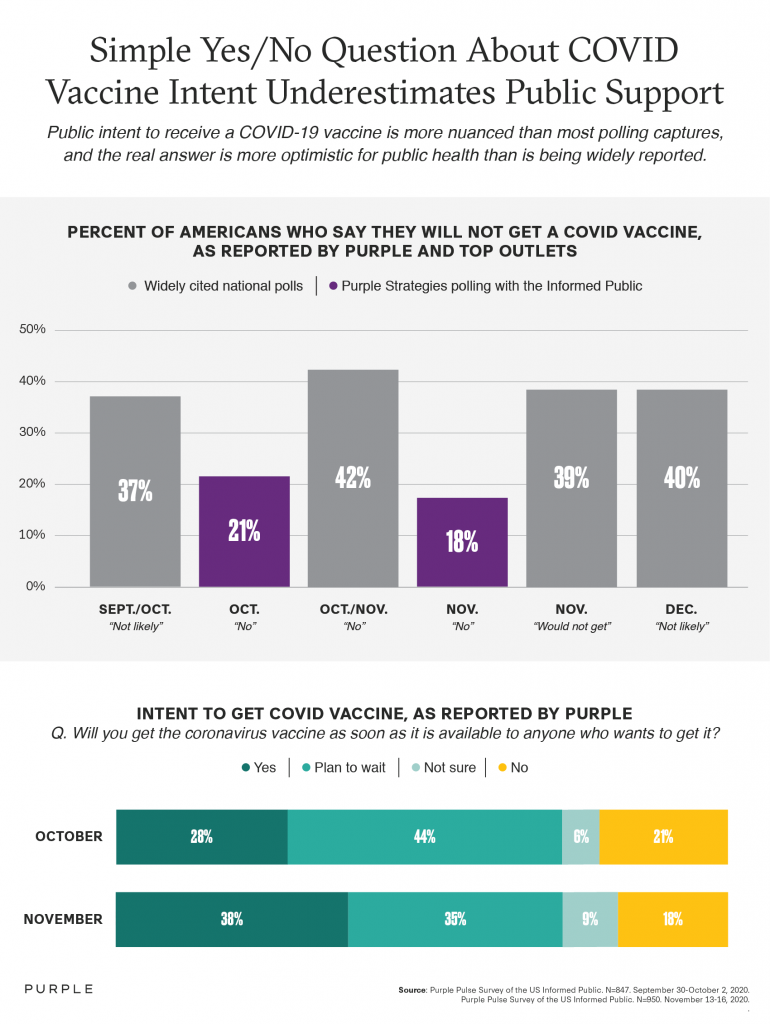

Are you asking the right question? Simple Yes/No About COVID Vaccine Intent Underestimates Public Support

Public intent to receive a COVID-19 vaccine is more nuanced than most polling captures, and the real answer is more optimistic for public health than is being widely reported.

Horserace political news coverage has always driven a large audience for media companies. So it’s no surprise that news organizations have keyed in on the next critical binary choice Americans face: Will people get the COVID vaccine?

The headlines and the polling on this question, however, can tell an incomplete and frequently misleading story about COVID vaccine hesitancy – inadvertently inflating the number of Americans who are not planning to get the vaccine.

According to most recent polls that are being widely reported in the media, roughly 4 in 10 Americans have indicated that they are not likely or not planning to get the vaccine when it is available. For example, here are recent poll numbers from four different national polls recently cited in the media:

- December poll: 40% not likely

- November poll: 39% would not get (probably + definitely)

- October/November poll: 42% no

- September/October poll: 37% not likely

If 40% are refusing to get vaccinated, there is certainly reason for concern. While not naming an exact figure, public health officials have indicated that “the vast majority” of us need to be vaccinated to get to herd immunity. So clearly, a lot is riding on increasing our collective level of coronavirus vaccine confidence and trying to persuade that still-too-large number who say “no” to the vaccine to join the “yes” camp.

Understanding public opinion requires asking the right questions.

Asking people how likely they are to get the vaccine, or asking them a simple binary yes or no question, over-simplifies what for many people is a much more nuanced decision – one that for many must account not just for whether, but also when to get the COVID vaccine. For this reason, we have been asking this question differently in our own public opinion polling. In our most recent poll, we find that some people plan to get the coronavirus vaccine immediately, as soon as it is available (38%); some people are more comfortable waiting a period of time before getting a vaccine (35% in our most recent poll, and of those, half say they just want to wait for others to get the vaccine first to ensure that there are no side effects and that it is as safe and effective as promised); and 9% say they are undecided or not sure. That leaves only 18% in the “no” camp, which incidentally, has moved relatively little since our initial poll.

Bottom line: Whether you are tracking public opinion about a public health challenge or about the reputation of a Fortune 100, the questions you ask and the way you ask them can drive vastly different results.

Purple is actively partnering with companies and industries to navigate the ever-changing COVID-19 pandemic and prepare for the future that will come after, bringing deep experience helping the world’s best-known companies navigate the world’s toughest challenges. Please reach out to author Denise Brien or any member of our Purple team to let us know how we can support you.

By Denise Brien | Managing Director | denise.brien@purplestrategies.com

Posted on

December 9, 2020

1 Min. Read

Author

Purple Strategies

Futurecasting Insights Unveiled for America’s CEO

Purple partner Chris Durlak is a featured expert in the latest issue of The CEO Forum magazine, sharing insights for CEOs from Purple’s new Futurecasting platform. His article outlines what it takes for leaders to build and protect their corporate reputation, based on insights derived from in-depth interviews with 40 executives charged with the reputations of some of the world’s most important companies and brands.

“Change is constant,” Durlak writes. “Stakeholders including consumers, the public, policymakers and investors are demanding more from corporations than ever before. From Black Lives Matter to immigration to climate change, the public expects corporations to play a role in advancing more than just their business.”

Read the full article, or access the complete issue – “10 Transformative CEOs Strengthening our New World Through Leadership” – for more insights for today’s chief executives.

Explore more of the Futurecasting insights at futurecasting.com.

Posted on

December 4, 2020

4 Min. Read

Author

Sarah Simmons

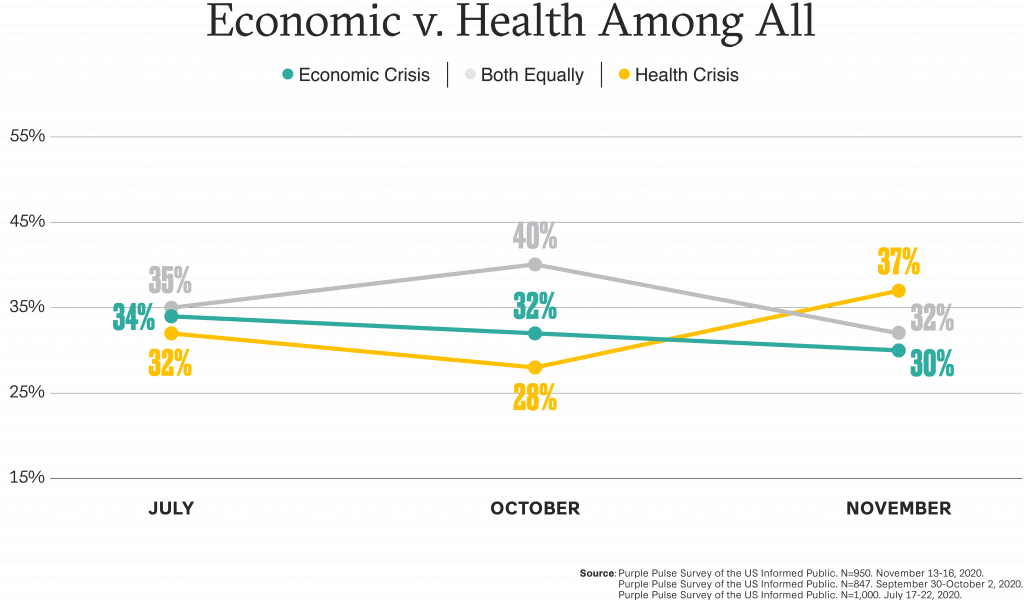

Health Concerns Outpace Economic As COVID Cases Surge

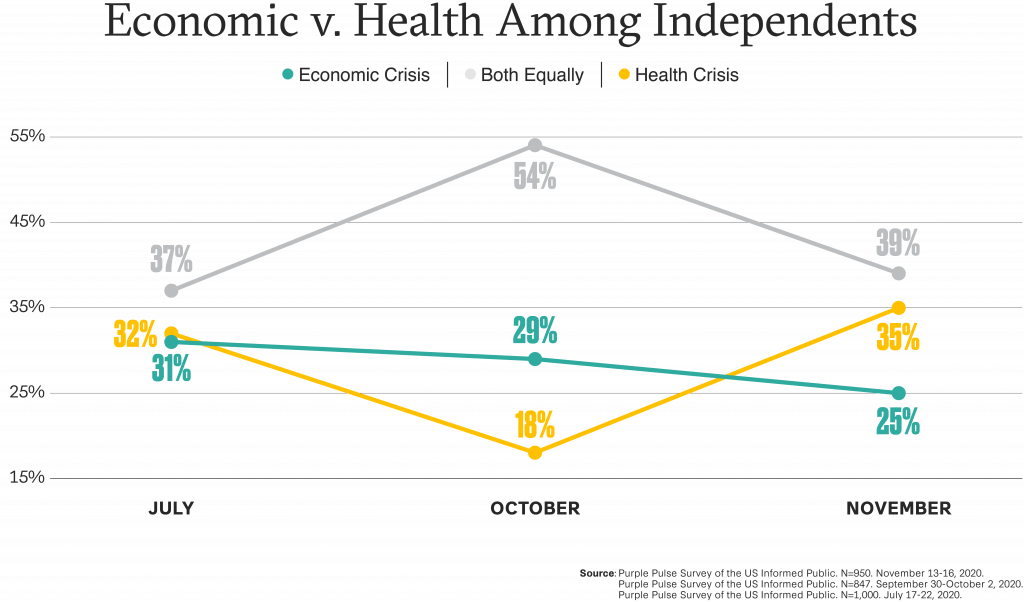

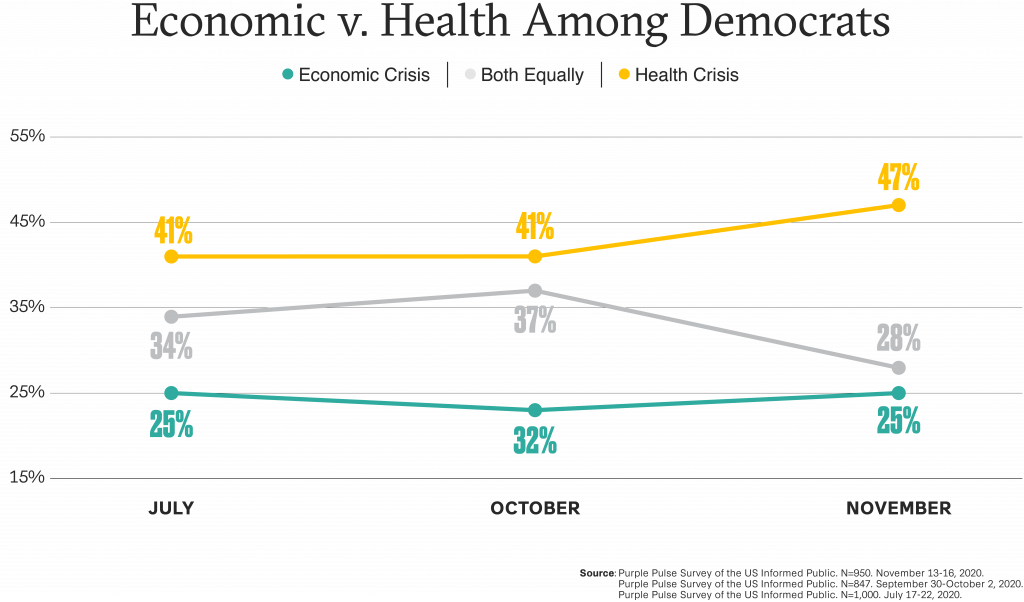

Research from mid-summer 2020 showed a distinct partisan divide in how Americans viewed the pandemic. Republicans largely believed COVID-19 was an “Economic Crisis” and Democrats were much more likely to believe COVID-19 was a “Health Crisis.” As the crisis has worsened across most of the United States this fall – in terms of cases as well as economic hardship – there’s been a definitive shift in partisan attitudes.

What the data say

Concern about COVID-19 has shifted, from an “Economic Crisis” to primarily a “Health Crisis.” More Americans now believe COVID-19 is a Health crisis than an Economic one. Attitudes have tracked the path of the virus: in late summer and early fall, concerns about the health impact eased somewhat, while economic worries stayed consistent. But as case counts have surged, so too have concerns about the health impact of the virus.

- As the second wave of COVID-19 is sweeping the nation, today nearly two-in-five (37%) believe the crisis is primarily a health crisis, versus 30% who currently believe it is an economic one. This is a marked increase from late September when only 28% viewed COVID-19 as primarily a health crisis.

Partisan differences remain, but significant attitudinal changes reflect the second wave of the virus. As the virus surged outside of the coasts and throughout the Midwest, and thus out of left-leaning cities and into more suburban and rural areas dominated by Republicans, the health implications of COVID-19 have become front and center for more Americans.

- Republicans’ core concern about the economy is weakening. While a core group of Republicans still believe COVID-19 is an economic crisis (40%, compared to 45% in the summer/early fall), attitudes have shifted. A greater number of Republicans now believe that COVID-19 is a health crisis (26%), up 7 points from 19% in late summer and before the recent surge in cases.

- Independents’ attitudes follow the virus. Independents’ attitudes have followed COVID-19’s progress through the country. Early in the summer, as the virus appeared to be coming under control, Independents were evenly split between believing the crisis was health (31%) or economic (32%). In early September, as many communities had observed several weeks of COVID-19 being more under control, the majority of Independents believed COVID-19 was a mix of an economic and health crisis (54%), and fewer than one-in-five (18%) believed it was mostly a health crisis. As cases surged in October and November, Independents have shifted dramatically to viewing the pandemic as a health crisis (from 18% to 35%).

- Democrats remain focused on health considerations. Democrats have consistently been more likely to see COVID-19 as a health crisis, with more than two-in-five taking this view throughout the surges and retreats of the virus since summer. However, by our mid-November poll, that percentage shot up to 47%, while the number equivocating that the crisis is equally an economic and health crisis fell considerably.

What it means

The all-party increase in belief that COVID-19 is primarily a health crisis matches the surge in cases, but it does not indicate concern about the economic impact has dissipated. Political divides remain and impact how many are viewing the crisis. What does that mean for businesses?

- Health concerns will materialize in places where they may not have been a universal priority before the most recent surge in case counts – see the reversal of many GOP governors on mask mandates and mandatory business/school and new community lock downs and restrictions.

- Americans will continue to view opening and closing through their partisan values – though at this point the majority of Americans take the view that at least some restrictions will be necessary to get the virus under control.

- Republicans are less in favor of state and local governments mandating that businesses close entirely to reduce the spread of the virus, but most (60%) agree that some new restrictions will be necessary.

- Democrats will be skeptical of corporate intentions regarding balancing health and safety with decisions to stay/remain open; 60% think that states should do “whatever it takes” to reduce the spread of the virus, including forcing businesses to close temporarily.

Decision makers need to remain aware that customers and stakeholders are judging their COVID response plans through this ideology. How companies respond now has the potential to impact their reputation for the long term, which means hitting the cues and proactively planning for and managing reputational impact will be essential.

What we should do, a reminder

- Identify your bubble and step out of it. Attitudes for partisans are very consistent, but Independents are changing with the intensity of COVID in their communities. That means critics will come from both sides. Understand how your framing of announcements will be understood among those with different points of view to help to protect against the politicization of your actions.

- Heed the changing environment. Decisions need to be tempered and framed by what is happening in real time and adjusted as the circumstances shift. As caseloads grow, emphasizing health and safety will be critical, but as the pendulum swings back and access to a vaccine increases, economic concerns will be prioritized again.

- Talk about it. Communicating about your efforts must be more than a “checking the box,” one-time exercise. Communicate consistently the values that are driving your decision to re-open or stay closed. Be visible and vocal about how you are protecting employees and customers. Plan to communicate often, and as often as the situation is changing.

PURPLE PULSE SURVEY OF THE US INFORMED PUBLIC. N=950. NOVEMBER 13-16, 2020.

PURPLE PULSE SURVEY OF THE US INFORMED PUBLIC. N=847. SEPTEMBER 30-OCTOBER 2, 2020.

PURPLE PULSE SURVEY OF THE US INFORMED PUBLIC. N=1,000. JULY 17-22, 2020.

Purple is actively partnering with companies and industries to navigate the ever-changing COVID-19 pandemic and prepare for the future that will come after, bringing deep experience helping the world’s best-known companies navigate the world’s toughest challenges. Please reach out to author Sarah Simmons or any member of our Purple team to let us know how we can support you.

By Sarah Simmons | Managing Director | sarah.simmons@purplestrategies.com

Posted on

November 16, 2020

5 Min. Read

Author

Rory Cooper

2020 Post-Election Outlook on a “Purple” Congress

View this analysis as a PDF.

Important Note: For the purposes of this guidance, we are going to assume that Democrats are not able to pick up both seats in the U.S. Senate runoffs in Georgia. This would mean that we have a Democratic White House, a slim Democratic majority in the House and a slim Republican majority in the Senate. If Democrats do pick up both seats … expect a fresh outlook.

What We See

By signaling and sometimes even calling himself a “transitional candidate,” President- elect Joe Biden may have summoned an eager and early field to the starting blocks of a 2024 race that may not include him. If a campaign with no incumbent were to occur, there are a number of candidates, including the 800 pound gorilla who has yet to concede defeat, who may already be thinking about their future, their role, or planning a campaign.

President Donald Trump may tease a 2024 run, or even embark on one. And if he were to do so, he’d currently be the prohibitive favorite. That will not change without a change in circumstances for either Trump or the party. So he will likely maintain a leading voice in the party and will hold significant sway over the GOP primary electorate and even congressional activity. This will add a historic amount of early outside pressure to lawmakers.

That’s bad news for Vice President Mike Pence who will be seeking his due from four years of loyalty and will suffer from a lack of oxygen despite likely attempts to try and influence policy. The Trump family, including Don Jr. and Ivanka, will remain political celebrities with outsized voices, even over established legislators.

Despite the Trump orbit, you will have a many Senators vying for national attention from different corners of the ideological spectrum so they can also be positioned for a run. Tom Cotton (R-AR) may be asserting himself as a national security candidate. Ted Cruz (R-TX) may look to reclaim some of his 2016 conservative credibility with a dose of Trumpism. Josh Hawley (R-MO) may look to grab the more populist conservative wing. Ben Sasse (R-NE) may align with constitutional conservatives who want a return to more sober leadership. Mike Lee (R-UT); Marco Rubio (R-FL); Tim Scott (R-SC); and Rick Scott (R-FL) will also be positioning themselves, the latter of which will run the NRSC at a moment when a difficult midterm looms.

Outside Washington, you will have former Ambassador Nikki Haley, Governors Larry Hogan (R-MD); Ron DeSantis (R-FL); Greg Abbott (R-TX); and potentially some surprises vying for national attention. And you will have the quixotic ambitions of some House Republicans as well.

On the Democratic side, it is highly likely the 2024 nominee will be Vice President- elect Kamala Harris but that is not a certainty and she will be seeking to define an independent role for herself inside the administration to demonstrate leadership and experience. This would follow the pattern set by Vice Presidents Cheney, Biden and Pence as more hands-on figures.

This is not to handicap the 2024 race before Biden is even inaugurated but to indicate that leading decision-makers in Congress are already jostling for political position with significant outside pressure, and in a period of divided government where little may get done, that matters.

Trump voters, or the apparent threat of Trump voters will continue to loom large. One mistake often made in Washington is assuming a Member of Congress fears the president. What they fear is a backlash from his voters and a difficult primary. Republican members in both chambers will continue to read the tea leaves of the MAGA grassroots for direction. Whether a split emerges between MAGA and other Republican/conservative grassroots audiences will largely depend on if the GOP primary beginning right after the 2022 midterms defines that battle or if the candidates merely compete for a share of the pie.

The Democratic side will continue its own battle from within between younger progressives and older pragmatics. The progressive wing is restless and wants systemic change, which will be nearly impossible to come by with a Republican Senate. So, their energy may be focused on the 2022 midterms which are favorable to Democrats. The quandary is whether that progressive energy will simply produce candidates that are too progressive to win general elections in Pennsylvania, North Carolina, Iowa or Wisconsin. And whether they can buck the trend of first term presidents facing a midterm backlash.

And Democrats will be wrestling with what went wrong in 2020. Sure, they won the White House, but their down ballot races were a failure. They had a net loss of state legislatures right on the eve of redistricting. Their Senate races defied all polling, the wrong way. And Speaker Nancy Pelosi was barely able to maintain her majority.

Progressives in the House led by Alexandria Ocasio-Cortez (D-NY) will have considerable power. Think back to the power that the Freedom Caucus had over Speakers John Boehner (R-OH) and Paul Ryan (R-WI). By packaging a small block of votes, they can determine what can and cannot be successful on the floor. Moderates could do the same, but it’s much less likely you see them draw the same hard line.

Meanwhile, House Republicans have only become more emboldened. Their opposition will reach fervent heights, especially with new members representing the full MAGA wing of the party. So, it’s unlikely we’ll see much if any cross-aisle collaboration in the House.

House Democrats will push highly liberal bills to the Senate, where they will be rejected. They will complain that Senate Majority Leader Mitch McConnell (R-KY) is holding them up. And any legislation with a chance of becoming law will have to be crafted by bipartisan gangs in the Senate driving toward an outcome where Minority Leader Chuck Schumer (R-NY), McConnell and Biden force Pelosi’s hands more often than not.

If this sounds like déjà vu all over again, it’s because it is. We are returning to a traditional divided government atmosphere much like what we saw in the Bush and Obama administrations. And a major reason why Senators Susan Collins (R-ME) and Joe Manchin (D-WV) will hold considerable power.

Finally, the Biden cabinet will resemble a Democratic coalition but also a negotiating apparatus. They will carry more traditional policy portfolios and may be the difference between Biden getting some things done or merely keeping the White House warm.

What It Means

Look for Republicans and Democrats to find common enemies or objectives when and if possible. This could mean:

Pharmaceutical industry in the crosshairs:

Republicans have traditionally protected the industry from Democratic impulses in the name of cost-cutting. But as the party has grown more populist, so has its relationship with business. With that said, the pharmaceutical industry has perhaps never had a year like 2020 where their value and innovation were more recognized.

Healthcare tug-of-war:

Biden ran on the expanding the promise of the ACA. He also led a major initiative to cure cancer. A Republican Senate is very unlikely to expand the ACA, but they may be able to find a number of areas of agreement to clear the decks of issues like pre-existing conditions. This will remain the major policy issue in Washington.

Immigration, again:

Like on healthcare, Senate Republicans may see some merit to clearing the decks of some lingering immigration issues, especially after seeing some modest electoral gains in 2020. The question remains whether hardline House Republicans allow this to happen, even if their votes are irrelevant. If Biden makes certain unilateral moves, we could be right back to the 2013-2014 dynamic.

It’s finally Infrastructure Week:

Embracing a large infrastructure package is the kind of pork-heavy effort that could entice a former Senator like Biden and members in both parties. Republicans are likely to become born-again fiscal conservatives so that could remain a hold up, but they also have infrastructure priorities. Democrats could also use this as a vehicle for climate change bargaining chips.

The tech industry under fire:

Both sides have significant issues with how tech and social media companies are behaving and how they self-regulate. Republicans, led by Hawley, could look for openings of oversight and regulation that the industry may object to, but their users may not.

Big COVID-19 stimulus:

Even with Republicans’ newfound fiscal responsibility, it’s likely that the turn of the year will see enough economic repercussions from 2020 that a large support bill will become inevitable, even if the lame duck is able to advance something in the meanwhile.

CBO becomes powerful once again:

Remember CBO scores? Republicans once lived or died by them and they will once again. Spending will be an issue on the right despite cries of hypocrisy from the left.

Omnibuses, CRs, debt limits, oh my:

Federal budgeting will take a sharp turn back toward brinksmanship for all of the political reasons already noted. Expect fiscal cliffs and potential shutdowns to come back into play.

Voting rights:

Voting rights was once considered the potential vehicle to end the legislative filibuster, especially after the loss of Congressman John Lewis (D-GA). After widespread criticism from Democrats in 2016 and from Republicans in 2020, we may see an opening for new federal standards and protections. The question is whether they can bargain in good faith on issues of ID, ballot counting, accessibility, etc.

Judges:

Democrats may still believe court-packing was a necessary reaction to Trump’s SCOTUS picks. But it was not politically popular. Justice Breyer may choose to retire with Joe Biden as president. Perhaps an opening for…Merrick Garland? This may not be the ideal progressive choice but may be what cools the temperature in the Senate, which is one of Joe Biden’s campaign goals.

Make alliances great again:

With Joe Biden unable to move major legislative packages, he may seek comfort

in repairing America’s relationship with the UN, NATO, WHO and other alliances. Reasserting a U.S. commitment to the Paris Accords could be the opening salvo. The issue of trade is more difficult to predict. Populist Republicans largely co-opted the Democratic trade platform under Trump. Whether Democrats seek to counter Trump’s moves, especially with China, or to let them lie remains to be seen.

Another four years of a pen and phone:

President Obama enacted major reforms and regulations via executive order and agency rulemaking. President Trump did the same. Expect President-elect Biden to carry on the new normal, reversing his predecessor and enacting his own administrative agenda.

What You Should Do

This is a difficult political climate for companies, issue organizations and coalitions. Political alliances are shifting, and headwinds and tailwinds are becoming harder to read. While divided government can often slow legislation and spare new regulation, it can also become highly unfavorable if you find your company or industry a target with bipartisan agreement.

Be prepared:

Shortly after the inauguration is a good time to be in the field with quantitative and qualitative research to see if and which expectations of your stakeholders and audiences have shifted since the election and how you can effectively communicate with them over the next 6, 12 and 18 months.

Prioritize stakeholders:

The winter months mean a surge in COVID-19 cases and economic repercussions, and 2021 will bring a new political climate as we’ve outlined. The stakeholders who mattered in 2019 and 2020 may have changed. This includes consumer and activist-led audiences as well the policymaker and opinion former audiences they influence. You can have a message that resonates broadly, but your time and resources should be prioritized to impact business and policy outcomes.

Communicate early:

It will take some time for Washington to regain solid footing in 2021, with COVID still an outstanding crisis and the fog of the Trump era still omnipresent. Rather than wait for the issue or crisis to come to you, 2021 will offer opportunities to take action and build dialogue with stakeholders, building equity you may need to draw on in policy battles later next year or in 2022.

Identify significant milestones in your path:

As the environment changes, so do the dates that matter. Whether it be shareholder expectations, critical business-driven moments or the political calendar, mapping your activations around these milestones is good campaign management. This can be done knowing that you will also need to be flexible given the high number of unknowns in the year ahead.

Change your paid media cadence:

The Trump era redefined the media diet for policymakers and those who influence them, which was a good situation if you sold airtime for Fox & Friends. Audiences are now more fragmented and diverse and will require better targeted content, more value- centric messaging and thoughtful channel planning. Finding the people who matter is more important than ever, rather than attempting to reach the old audience-of-one who is watching last night’s Tucker Carlson in the White House residence.

Analyze your third-party advocates and critics:

Just as you are re-evaluating your footing, so are your opponents. Now would be a good time to reassess which alliances look solid and which could splinter in the months ahead. More often than not, third-party allies are called upon when they are needed, creating a transactional relationship where a trusted, strategic one would be even more valuable. Use this time of transition and uncertainty to reevaluate and renew advocates and to assess potential threats.

Despite our best attempts, 2021 is a difficult year to predict. There are considerable external and internal pressures on legislative activity; a divided government; a Trump hangover; a still-omnipresent pandemic; and critically unstable economic conditions. At Purple Strategies we’ve helped some of the world’s greatest companies deal with the world’s toughest challenges. We stand ready to help you navigate these changes, fortify your reputation, and address any headwinds. Please don’t hesitate to reach out to author Rory Cooper or any member of the Purple team.

Rory Cooper | Managing Director | rory.cooper@purplestrategies.com

Posted on

November 9, 2020

5 Min. Read

Author

Nicki Zink

COVID Vaccine Concerns Are Widespread Yet Partisan

Party ID & Where You Get Your News Drives Unique Factors of COVID-19 Vaccine Hesitancy

From where you grew up to where you get your news, different experiences can lead to different beliefs and opinions on important societal topics. This principle has been brought to life when it comes to how people view the coronavirus pandemic.

For example, political affiliation may lead a person to view the pandemic as a different type of crisis. Our recent research shows that Republicans view COVID-19 primarily as an economic crisis and believe re-opening should be a top priority. In contrast, Democrats view COVID-19 primarily as a health crisis and believe caution should be the guiding force, even if it is costly to the economy.

These differing perspectives can translate not just to different world views but also to different choices that have immediate impact.

One key choice that will be crucial in stopping the spread of the coronavirus is whether or not to get vaccinated, and the perceived quickness of vaccine development is becoming a liability. Just 30% of the informed public say that they are going to get vaccinated for the coronavirus as soon as a vaccine becomes available. And Republicans are more likely than Democrats to take this position.

*Will you get the coronavirus vaccine as soon as it is available? SOURCE: Purple Pulse Survey of US Informed Public. N=847. September 30 – October 2.

Below we dive deeper into party identity and news consumption habits and how a person’s political party affiliation or source of news may lead to different beliefs, and then different vaccine choices based on those beliefs.

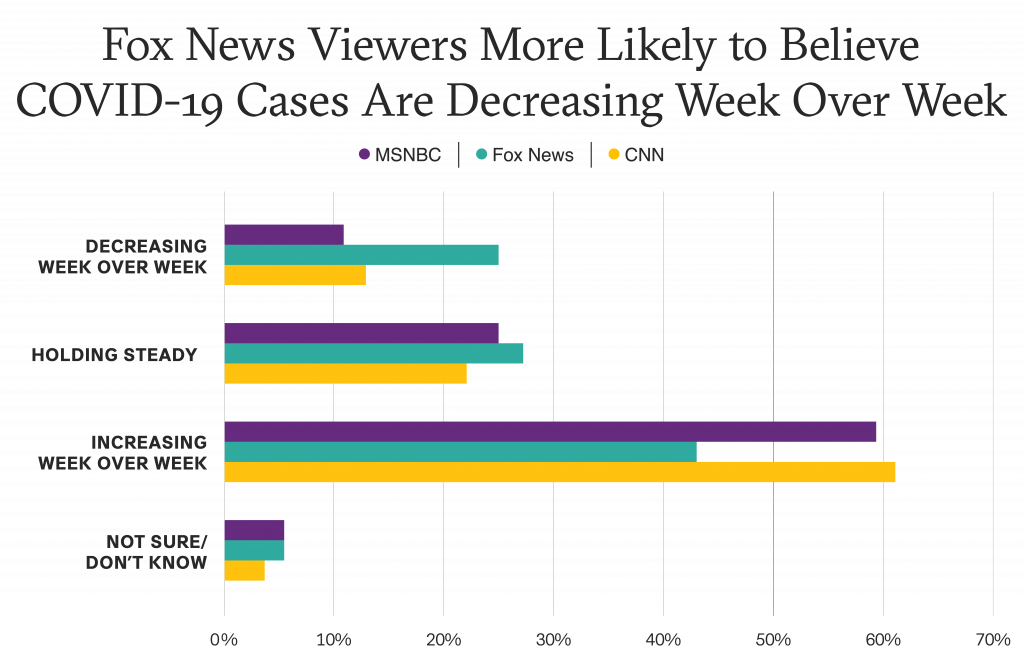

News flow on the right and left may be hurting our ability to stop the spread of the coronavirus, but for different reasons.

• On the right, there is an increased belief that coronavirus cases are going down over time, negating the need for a vaccine for some. Fox News viewers are more likely than CNN or MSNBC viewers to believe that U.S. coronavirus cases overall are decreasing week over week.

*To your knowledge, which best describes the current trend of coronavirus cases today, in your state and in the US overall? SOURCE: Purple Pulse Survey of US Informed Public. N=847. September 30 – October 2.

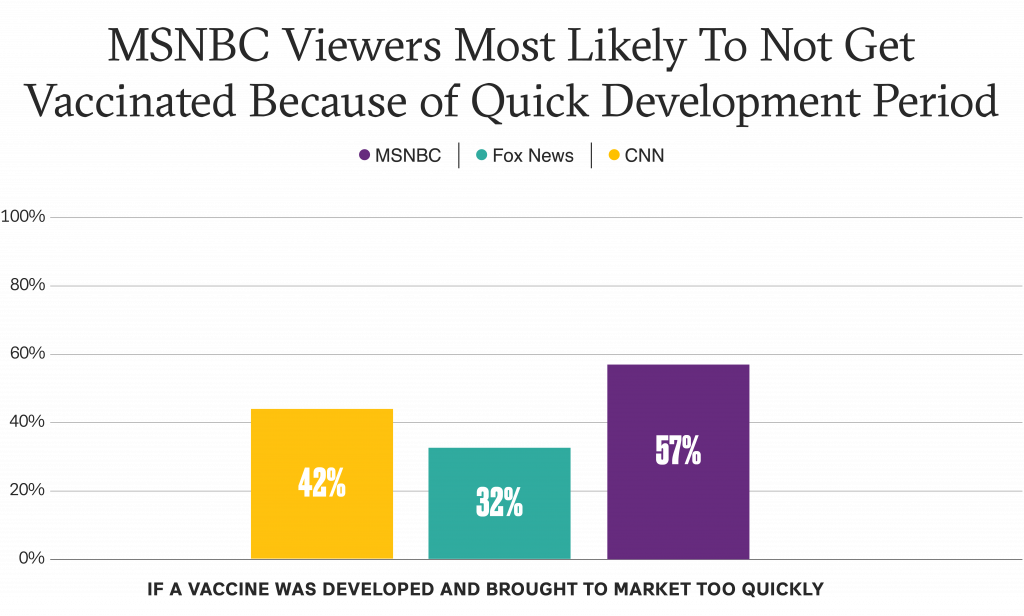

• On the left, coronavirus vaccine hesitancy is driven in part by concerns about the vaccine development process being rushed. Liberal cable news viewers are significantly more likely to not get vaccinated for the coronavirus if a vaccine is developed and brought to market too quickly. This view is most strongly held by MSNBC viewers, over half (57%) of which say a vaccine that was developed and brought to market too quickly would influence their decision not to get vaccinated.

*Which of the following factors would influence your decision not to get vaccinated for the coronavirus? SOURCE: Purple Pulse Survey of US Informed Public. N=847. September 30 – October 2.

• An analysis of comments on similar Fox News and CNN Facebook posts about a coronavirus vaccine show that commenters on the CNN post express more negative opinions about a vaccine than Fox News commenters. Over 1/3 (35%) of comments on CNN’s post were critical of a vaccine compared to just 17% of comments on Fox News’ post which shared a similar sentiment. Critiques of an eventual coronavirus vaccine were multifaceted but many expressed that they did not want to get a “rushed vaccine” or be “guniea pigs.” Others proposed that conservative elected officials and their families should get the vaccine first.

Non-partisan subject matter experts are viewed with a partisan lens.

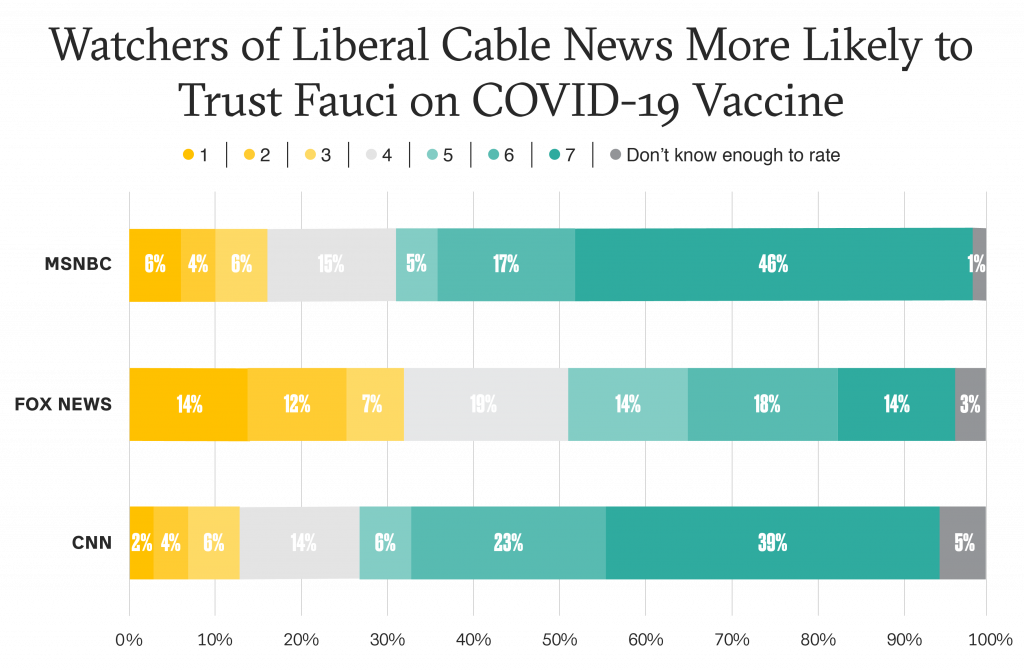

• Anthony Fauci has been a central figure to the U.S. coronavirus response and is widely regarded as the nation’s top infectious disease expert. He is frequently cited by media and referred to with similar titles by right- and left-leaning outlets. But a person’s news consumption may impact whether or not they trust him.

• CNN and MSNBC viewers are also significantly more likely to trust Fauci to say whether or not a coronavirus vaccine is safe and effective.

*How much do you trust the endorsement of the safety and effectiveness of a coronavirus vaccine from each of the following? SOURCE: Purple Pulse Survey of US Informed Public. N=847. September 30 – October 2.

• An analysis of comments on Facebook posts which mention Fauci and a coronavirus vaccine further demonstrate that commenters have different reactions to him. Fox News commenters are more likely to express a negative view of Fauci than CNN commenters. 618 comments (38%) on Fox’s post from September 18 are highly critical of the infectious disease expert writing things like, “he flip flops more than anyone I’ve seen,” “This man can’t be trusted,” “I wouldn’t believe a word this man says,” “I would bet he’s got a lot of stock in the company that makes it too” and “This guy tells false information he’s a liar a disgrace he’s working for democrats needs to be put in jail.” This sentiment is expressed in just 32 comments (4%) on CNN’s Facebook post.

In order to combat these varying factors driving coronavirus vaccine hesitancy, it’s important for entities in this space to meet audiences where they are.

This can be accomplished by:

• Developing a deep understanding of key audiences. In order to best engage the audiences that matter to your brand and move them to where you want them to be, it is crucial to understand not only who they are, but what they believe.

• Creating audience-specific messaging, not “one size fits all.” How you tell your story matters. Create custom messages for audiences based on their starting places in order to ensure your message resonates.

• Using a variety of surrogates to tell your story. Different voices appeal to different people. Find a variety of voices who can amplify your message and resonate with the audiences that matter to you.

By Nicki Zink | nicki.zink@purplestrategies.com

Purple is actively partnering with companies and industries to navigate the ever-changing COVID-19 pandemic and prepare for the future that will come after, bringing deep experience helping the world’s best-known companies navigate the world’s toughest challenges. Please reach out to author Nicki Zink or any member of our Purple team to let us know how we can support you.

AI and Paradigm Shifts on the Minds of Healthcare CEOs

AI and Paradigm Shifts on the Minds of Healthcare CEOs  Purple Strategies Elevates Three To Partnership Group

Purple Strategies Elevates Three To Partnership Group